CDHP Basic

Plan highlights

How the plan works

For more information

The CDHP Basic blends comprehensive PPO medical coverage with a tax-advantaged Health Savings Account (HSA) you can use to pay for qualified medical expenses now and into retirement. Together, the medical coverage and HSA give you greater control over how you spend your health care dollars and helps you build savings for future medical expenses.

If you aren't eligible for an HSA, the Company will establish a Health Reimbursement Account (HRA) for you instead.

This plan is administered by Aetna.

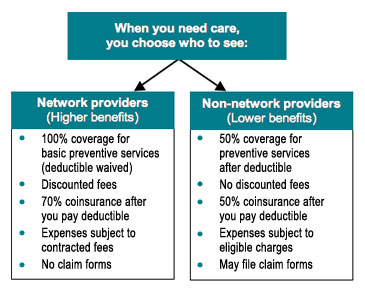

- The CDHP Basic uses Aetna's PPO network of doctors, hospitals, and facilities. You'll pay less when you use providers in Aetna's PPO network.

- Preventive care is covered at 100% when you use network providers.

- Except for preventive care, you must meet a deductible before the plan pays for any of your medical care.

- After you meet your deductible, the plan pays 70% of your eligible medical care expenses when you use network providers, and 50% for non-network providers.

- Prescription drugs are covered by the plan. The amount you pay for prescription drugs depends on whether the medication is considered preventive or non-preventive, and if you obtain it at a retail pharmacy or through the mail order program. Please see prescription drug coverage for details.

- The family deductible can be met with any combination of expenses incurred by any family member, except that one person can never incur deductible expenses above the individual limit. When the family deductible amount is met, the rest of the family will receive benefits.

- The CDHP Basic comes with Health Savings Account (HSA) that is funded by the Company with tax-free dollars. You may also contribute money on a tax-free basis. The HSA is a personal account for health care expenses. You decide how to use your HSA dollars—save or spend depending on your needs. If you ever leave the Company, you take your HSA with you. If you're not eligible for an HSA, the Company will open a Health Reimbursement Account (HRA) for you, and you'll receive the same amount of money that people with HSAs receive.

- Certain procedures and admissions require prior authorization (pre-service review) from Aetna so that they can be determined for medical necessity. Examples include, but are not limited to, MRI and other advanced imaging procedures, scheduled non-emergency hospital and residential treatment center admissions, transplant services, physical therapy and chiropractic services that exceed the plan's number of visits, and treatment for pervasive development disorder or autism.

Because of their tax advantages, the IRS has rules about who is eligible to open or contribute to an HSA. If you are not eligible for an HSA, the Company will make the contributions to your Health Reimbursement Account (HRA).

If you have an HSA

1. Your deductible—you pay out-of-pocket until you reach the deductible.

When you have an eligible expense, like a doctor visit, the entire cost of the visit will apply to your deductible. You will pay the full cost of your health care expenses until you meet your deductible. Medical and prescription drug expenses count toward your deductible. You can choose to pay for care from your HSA or you can choose to pay another way (i.e., cash, credit card) and let your HSA grow. It’s your choice.

2. Your coverage—your plan pays a percentage of your expenses.

You don’t pay anything out of your pocket for eligible preventive care as those expenses will be covered 100% when received from network providers.

For other services, once the deductible is met, your health plan has coinsurance. With coinsurance, the plan will pay a percentage of each eligible expense, and you will pay the rest. When you receive services from a network provider, the plan pays 70% of the cost, you pay 30%. When you receive services from a non-network provider, the plan pays 50% of the cost, you pay 50%.

3. Your out-of-pocket maximum—you are protected from major expenses.

An out-of-pocket maximum protects you from major expenses. The out-of-pocket maximum is the most you will have to pay in the plan year for covered services. The plan will then pay 100% of all remaining covered expenses for the rest of the plan year. Medical and prescription drug expenses, including your deductible and coinsurance, will go toward your out-of-pocket maximum.

For more information and details, see the Health Care Program Comparison.

If you have an HRA

1. Your deductible—your HRA pays first.

When you have an eligible expense, like a doctor visit, the entire cost of the visit will apply to your deductible. The HRA will pay for all of your eligible expenses first, as long as there is money in the account. This means you won’t have to pay anything until the HRA is depleted. Then, you will need to pay the full cost of your health care expenses until the remaining deductible is met. Medical and prescription drug expenses count toward your deductible.

2. Your coverage—your plan pays a percentage of your expenses.

You don’t pay anything out of your pocket for eligible preventive care as those expenses will be covered 100% when received from network providers.

For other services, once the deductible is met, your health plan has coinsurance. With coinsurance, the plan will pay a percentage of each eligible expense, and you will pay the rest. When you receive services from a network provider, the plan pays 70% of the cost, you pay 30%. When you receive services from a non-network provider, the plan pays 50% of the cost, you pay 50%.

3. Your out-of-pocket maximum—you are protected from major expenses.

An out-of-pocket maximum protects you from major expenses. The out-of-pocket maximum is the most you will have to pay in the plan year for covered services. The plan will then pay 100% of all remaining covered expenses for the rest of the plan year. Medical and prescription drug expenses, including your deductible and coinsurance, will go toward your out-of-pocket maximum.

For more information and details, see the Health Care Program Comparison.

The CDHP Basic gives you the freedom to see providers of your choice, but you'll spend less when you use a network provider. These network providers agree to set rates for services with Aetna and do not bill members for amounts above these rates. You pay less when you use network providers for three reasons:

- The plan pays higher benefits when you use network providers (70% for network providers and 50% for non-network providers).

- Your share of medical expenses is based on the discounted rate that Aetna negotiates with providers.

- Non-network providers may charge more than Aetna allows for a service, and you'll be responsible for any charges that exceed the allowed amount.

Locate PPO providers at aetna.com

Network providers will generally handle any required notification for you. However, you are responsible for ensuring that this process has been completed by calling Aetna at the number on your ID card.

The way you pay for eligible expenses will depend on whether you have a Health Reimbursement Account or a Health Savings Account.

If you have an HSA:

There are several ways to pay for eligible expenses using your HSA:

- Show your HSA debit card at the time of service when appropriate (e.g., doctor, dentist, pharmacy, and vision providers).

- Give your HSA debit card info over the phone.

- Use online bill pay at aetna.com.

- Write a check if you ordered checks for your account.

- If you paid for eligible HSA expenses with personal funds, reimburse yourself by check, ATM, or ACH.

- If there aren’t sufficient funds in your HSA to cover the entire expense, pay what you can with your HSA and the balance out of your personal funds.

- You can check your HSA balance and payments at Voya's website.

Tax tip: When you use your HSA, save the receipt for the eligible expense for your tax records. If the expense is not an eligible expense, do not pay using your HSA. Read more about eligible HSA expenses.

If you have an HRA:

- Show your medical ID card at the doctor's office, pharmacy, or hospital at the time of service.

- Aetna will automatically deduct eligible medical and prescription drug expenses from your HRA that count toward your deductible and coinsurance.

- You can check your HRA balance and payments at aetna.com.

View the Health Care Program Comparison for a summary of these benefits

Watch videos to learn more about HSAs

Visit Aetna's website if you aren't enrolled and want to locate network doctors, hospitals, and facilities (in the "Continue as a guest" section, enter your location and click "Search", and under the "Aetna Open Access Plans" section, click "Aetna Choice POS II (Open Access)", then click the "Continue" button)

Log in to www.aetna.com if you are enrolled and want to view your claim status, history of claims, and more

Learn how NurseLine can help you treat symptoms at home and avoid unnecessary trips to the emergency room

View the Aetna Preventive Drug List for which the deductible is waived

View the Summary Plan Description