Critical Illness

Critical illness benefit highlights

Wellness benefit highlights

Filing claims

Taxation of benefits

For more information

The cost of a critical illness can be significant. Medical coverage typically covers a large part of the cost, but not all. If you are diagnosed with a critical illness, this plan will pay you a lump sum benefit—separate from and in addition to your medical coverage. The plan also includes a wellness benefit that pays you money for receiving covered health screenings and mammograms.

You are automatically enrolled for a $5,000 Company-paid benefit. You may enroll yourself and your eligible dependents in voluntary critical illness. This plan is administered by Voya.

Please note: If you were enrolled in the UNUM voluntary critical illness plan on December 31, 2020 and you did not cancel your coverage, your basic Company-paid benefit will be provided through Voya and your voluntary critical illness coverage will continue to be provided through UNUM's critical illness plan.

- $5,000 basic Company-paid benefit for all eligible employees and children for covered critical conditions. The Company pays for full cost of basic Company-paid coverage.

- Voluntary coverage is available—you may purchase a critical illness benefit amount of $5,000, $10,000, $20,000, or $30,000 for yourself. If you purchase voluntary coverage for yourself, you may also purchase voluntary coverage for your spouse/domestic partner in amounts of $5,000, $10,000, $20,000, or $30,000, not to exceed 100% of your benefit amount. Voluntary coverage is paid on an after-tax basis through convenient payroll deductions.

- Eligible children are always covered at 25% of your basic and voluntary amount.

- The plan provides benefits for a wide variety of medical conditions and partial benefits for certain conditions.

- Children are also covered for additional specific childhood conditions as shown below.

- Use the money any way you choose—pay your medical plan deductible or coinsurance, cover your mortgage, or take a vacation.

- You don't have to be disabled or terminally ill to receive the benefit.

Covered medical conditions

Voya breaks out covered illnesses/conditions into groups called "modules". The covered condition/diagnosis must happen on or after your coverage effective date.

Base module:

- Heart attack—100%

- Cancer (invasive)—100%

- Cancer (non-invasive)—25%

- Stroke—100%

- Major organ transplant—100%

- Coronary artery bypass—100% of critical illness benefit amount

Major organ module:

- Type 1 diabetes—100% of critical illness benefit amount

- Transient ischemic attacks (TIA)—10% of critical illness benefit amount

- Ruptured or dissecting aneurysm—10% of critical illness benefit amount

- Abdominal aortic aneurysm—10% of critical illness benefit amount

- Thoracic aortic aneurysm—10% of critical illness benefit amount

- Open heart surgery for valve replacement or repair—25% of critical illness benefit amount

- Severe burns—100%

- Transcatheter heart valve replacement or repair—10% of critical illness benefit amount

- Coronary angioplasty—10% of critical illness benefit amount

- Implantable/internal carioverter defibrillator (ICD) placement—25% of critical illness benefit amount

- Pacemaker placement—10% of critical illness benefit amount

Enhanced cancer module:

- Benign brain tumor—100%

- Skin cancer—10% of critical illness benefit amount

- Bone marrow transplant—50% of critical illness benefit amount

- Stem cell transplant—50% of critical illness benefit amount

Quality of life module:

- Permanent paralysis—100%

- Loss of sight, hearing, or speech—100%

- Coma—100%

- Multiple sclerosis—100%

- Amyotrophic lateral sclerosis (ALS)—100%

- Parkinson's disease—100%

- Advanced dementia, including Alzheimer's disease—100%

- Huntington's disease—100%

- Muscular dystrophy—100%

- Infectious disease (hospitalization requirement)—25%

- Addison's disease—10%

- Myasthenia gravis—50%

- Systemic lupus erythematosus (SLE)—50%

- Systemic sclerosis (scleroderma)—10%

Additional child diseases module (applies to insured children only and is in addition to the other modules):

- Cerebral palsy—100%

- Congenital birth defects—100%

- Cystic fibrosis—100%

- Down syndrome—100%

- Gaucher disease, type II or III—100%

- Infantile Tay-Sachs—100%

- Niemann-Pick disease—100%

- Pompe disease—100%

- Sickle cell anemia—100%

- Type 1 diabetes—100%

- Type IV glycogen storage disease—100%

- Zellweger syndrom—100%

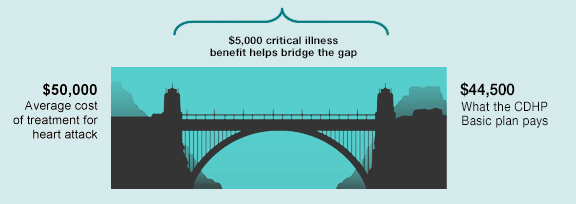

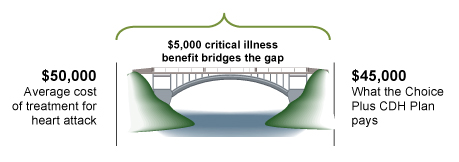

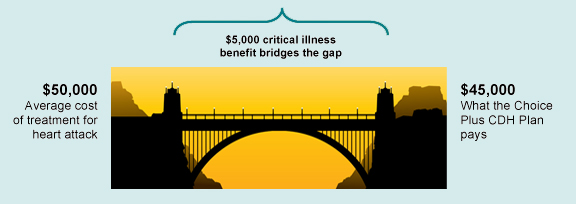

Bridging the gap—an example

There is typically a gap between the cost of medical services and what your medical plan pays. Let's take a look at how the critical illness benefit can help bridge that gap by offsetting your out-of-pocket expenses if you are diagnosed with a critical illness. For illustrative purposes, the following example assumes coverage under the CDHP Basic medical plan using network providers for in-hospital treatment relating to a heart attack.

In this example, you pay your individual out-of-pocket maximum ($6,000) and your critical illness benefit could be used to satisfy that amount. Because you use network providers, the CDHP Basic plan pays 100% of your eligible expenses for the rest of the year.

What's better than a critical illness benefit? Not getting sick in the first place. That's why the plan has a wellness benefit. Simply put, you get money just for obtaining your regular health screenings and mammograms. Many of these services are considered preventive by the Company medical plans, and are covered in full when you use Aetna network providers.

Health screenings (basic benefit only)

- Benefit amount. The plan pays an annual benefit of $75 for enrolled employees and their children who receive a covered wellness test or screening. If a person receives more than one test in a year, the plan will only pay $75. The annual benefit amount for each child is 100% of your benefit amount with an annual maximum of $150 for all children.

- Who's eligible. Employees and their eligible children.

- How often. The benefit is payable once per year for each covered person.

Health screening tests include but are not limited to:

- Blood test for triglycerides

- Pap smear or thin prep pap test

- Flexible sigmoidoscopy

- CEA (blood test for colon cancer)

- Bone marrow testing

- Serum cholesterol test for HDL and LDL levels

- Hemoccult stool analysis

- Serum Protein Electrophoresis (myeloma)

- Breast ultrasound, sonogram, MRI

- Molecular or antigen test (Coronavirus)

- Chest x-ray

- Mammography

- Colonoscopy

- CA 15-3 (blood test for breast cancer)

- Stress test on bicycle or treadmill

- Fasting blood glucose test

- Thermography

- PSA (prostate cancer)

- Hearing test

- Routine eye exam

- Routine dental exam

- Immunizations

- Well child/preventive exams through age 18

- Biometric screenings

- Electrocardiogram (EKG)

- Annual Physical Exam—Adults

- CA 125 (overian cancer)

- Tests for sexually transmitted infections (STIs)

- Ultrasound screening for abdominal aortic aneurysms

- Hemoglobin A1C (HbA1c)

- Bone density screening

Health screenings (voluntary benefits)

- Benefit amount. The plan pays an annual benefit of $100 for enrolled employees, spouses/domestic partners, and children who receive a covered wellness test or screening. If a person receives more than one test in a year, the plan will only pay $100. The annual benefit amount for each child is 100% of your benefit amount with an annual maximum of $200 for all children.

- Who's eligible. Employees, spouses/domestic partners, and eligible children.

- How often. The benefit is payable once per year for each covered person.

In addition to the wellness tests shown above for the basic plan, the voluntary benefit also includes mammography screenings.

You can file a critical illness or wellness benefit claim by phone or online. To file your claim by phone, call Voya at 877-236-7564.

To file your claim online, visit the Voya Claims Center.

- For a critical illness claim, click the "Get Started" button under "Start a Claim" and follow the instructions.

- For a wellness benefit claim, click the “Start Your Claim” button in the “Have a Wellness Benefit Claim?” section and follow the instructions.

Have the following information available:

- The group number (CMSU's group number is 694924)

- The name, date of birth, and Social Security Number of the patient and his or her relationship to you

- Medical records confirming the diagnosis if a critical illness claim

- Type of health screening, medical provider, and the test date if a wellness benefit claim

Taxation of Benefits

- Basic critical illness and wellness benefits are taxable to you. If you have received basic benefits from the plan, Voya will send you a 1099 form.

- Voluntary critical illness and wellness benefits are not taxable to you.

See the critical illness insurance overview

Visit the Voya website to learn more about critical illness insurance and file a claim.

Review the Critical Illness summary plan description