Sick Leave

The sick leave benefit replaces 100% of your salary if you become ill or injured outside of work. The maximum amount of sick leave depends on your years of service with the Company.

Sick leave benefits accrue from your date of hire, but you cannot begin using sick leave until you have worked for the Company for 90 continuous days. The rate at which you accrue sick leave depends on whether you are in a non-exempt or exempt status as shown in the tables below:

| Non-Exempt Employees |

| Years of Service |

Days Of Earned Sick

Leave Per Year |

| 0-10 |

10 |

| 11 or more |

15 |

| Non-exempt employees receive their entire annual grant of sick leave on each anniversary date. Unused sick leave carries over to the following year, up to a maximum total of 13 weeks. |

| Exempt Employees |

| Years of Service |

Days Of Earned Sick

Leave Per Year |

| 0-1 |

10 |

| 2-5 |

30 |

| 6-10 |

45 |

| 10 or more |

65 |

| Exempt employees receive their entire annual grant of sick leave each January 1. Unused sick leave does not carry over to future years. |

Sick leave benefits will be reduced by any other benefits you receive as a result of your illness or injury.

Important: You must provide a doctor's work release BEFORE returning to work—this is MANDATORY. The release must state if you are released to full-duty, or if you have any work restrictions. If you have work restrictions, the doctor must specify the work restrictions and duration. Your manager and the Legal Department must approve any work restrictions before you are permitted to work.

For further details about sick leave benefits, please refer to the sick leave policy on the Benefits section of the the Company Intranet.

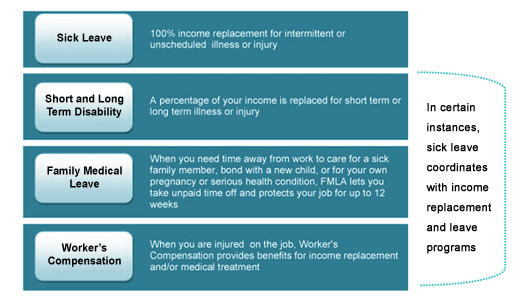

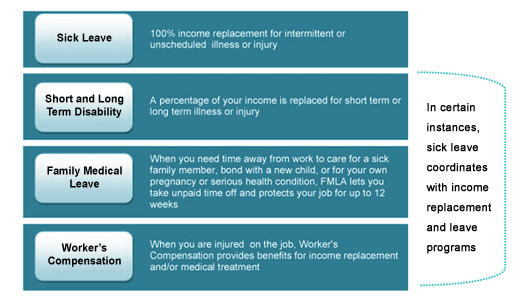

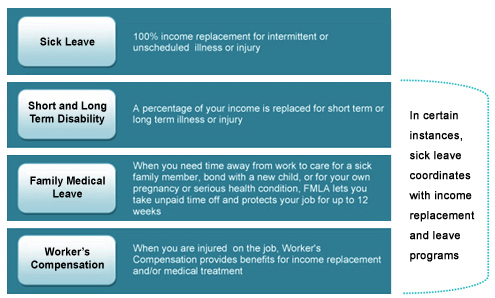

If you become ill or injured—putting it all together

If you become ill or injured, sick leave may be your first line of defense, but you have other Company-sponsored and government programs that work with sick leave. In other words, you will not need to use all of your sick leave if you are also eligible for other benefits.

Sick leave supplements benefits paid by other income replacement programs, and it can provide income during an unpaid family medical leave for your own disabling condition. When sick leave supplements other income replacement programs, you will not receive more than 100% of your pre-leave income.

Learn about short term and long term disability

Read the Department of Labor's Employee's Guide to the Family and Medical Leave Act and the FMLA Summary Plan Description

View the Workers' Compensation memo